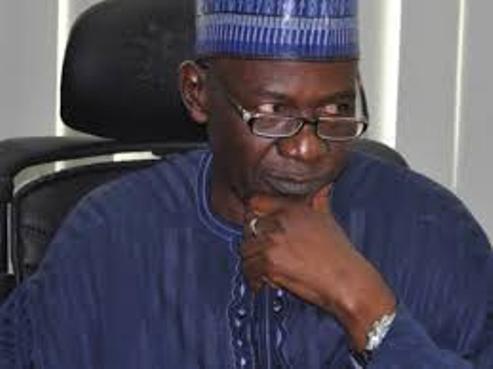

Speculation Bane Of Nigeria’s Forex Market-Bureau de Change Boss, Gwadabe

LAGOS SEPTEMBER 14TH (NEWSRANGERS)-The Association of Bureau De Change Operators of Nigeria, ABCON has said that the major challenge facing the country’s foreign exchange market is speculation.

Speaking in a exclusive interview, ABCON President, Alhaji Aminu Gwadabe said if not for the greed of few Nigerians who mop and keep the dollars thereby causing scarcity, the the country would not experience shortage of dollars and other foreign currencies at all.

According to Gwadabe with the ongoing policies of the Central Bank of Nigeria, CBN, those who engage in speculation will definitely loose in the present dispensation.

He said the naira was gradually firming-up against the dollar and other major currencies said the mere announcement of the resumption of sales of foreign exchange to Bureau De Change operators in the country led to about N47 appreciation in the value of naira to the dollar.

The ABCON, President noted that those who are in the habit of of undermining the system by mopping up the available dollars will only have themselves to blame as the rates will continue to crash.

He argued that with Nigeria’s external reserve at $32 billion, capable of supporting the nation’s imports for a period of six months, the rising demand for crude oil as well as the associated increase in the price of the commodity, in addition to the resumption of businesses in some of the developed countries where Nigerian citizens work and remit money back home by way of diaspora remittances ‘ as measures that will further assist the apex bank defend the naira and ensure stability.

For instance according data from the CBN Nigeria receives $17.5 billion diaspora Nigeria received $17.57 billion in direct diaspora remittances between January and November 2019. The remittances rose by 56.4 per cent when it increased from $11.23 billion within the same period in 2018 to $17.57 billion in 2019.

Gwadabe said ” Our reserve is at $32 billon which can cover about six months of imports. I’m not saying we should wipe out our reserve because it is also a measure of strength; a measure of capability that the CBN is having to at least defend the value of the naira. We are also witnessing the crude oil demand is rising, the prices are going up, which will give the Central Bank more muscle to defend the value of the local currency.

“The tactics of the. CBN Governor, you know he is somebody that is very unpredictable. You cannot predict a leader. Continue to give him issues, one day he will come with a surprise. Even we, he has warned us, if your members think they have an opportunity, I will make them incur losses”, Gwadabe said.

The ABCON President therefore cautioned the end users of forex on the need to avoid speculation. While advising government on the need to intensify its backward integration programme to enhance productive capacity ” if you want to mop up the dollars in the system, you are doing it at your peril because you will loose money. See, the gap is closing, so that is a pointer for those that will want to speculate. It is not profit, it is losses.

He advised the government to continue with the backward integration so that we can enhance our productive capacity,

“This is very important and the porous borders should be checkmated so that illegal cross-border payments will be tracked. The BDCs should be given more empowerment, more businesses, more scope of transactions to make the dollar readily available and at a competitive price” he said.

Short URL: https://newsrangers.com/?p=57163